Like you, we’ve heard a wide range of estimates – from industry analysts, research firms, and financial institutions – regarding the fraud rate in DDAs opened online. In the spirit of “more is better,” we would like to insert our own data into the conversation.

Kevari is in a unique position to conduct fraud-rate analyses; our platform captures information about new accounts that were investigated by banks and subsequently marked as “fraud.” In a sample of banks that opened accounts in branches and online, our data revealed:

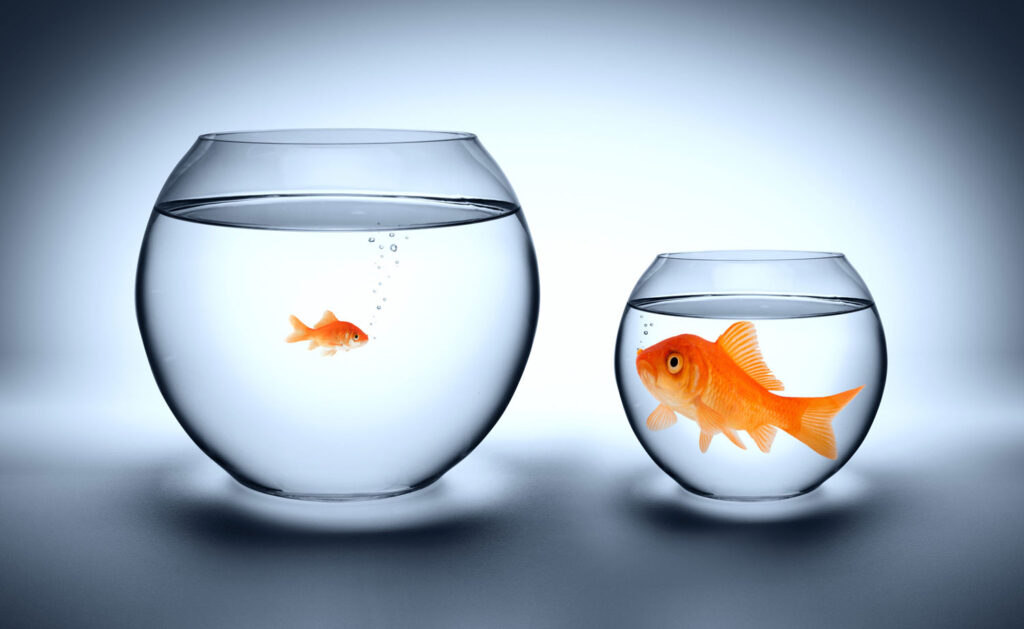

- 39% of accounts were opened online, but they represented 88% of the reported frauds

- Banks investigate more than 3x the percentage of online new account applications compared to branch applications

- The fraud rate was more than 11x higher in the online channel than in the branch channel

11x More Fraud Online?

Being data scientists, it’s in our nature think about the limits of our analysis dataset as well possible explanations for results. Could the online fraud rate really be 11x higher in the online channel?

It makes sense when you think about the difficulty of opening a fraudulent account in the face-to-face branch environment where identifying documents can be scrutinized and fraudsters have to travel from branch to branch to set up a fraud scheme.

Compare this to the ease and efficiency with which fraudsters can apply for accounts in a faceless online environment. They can use stolen PII repeatedly at numerous institutions – all while sitting at one computer.

Our velocity databases expose this online fraudulent activity daily. Identity elements, like SSN, email or address, are seen at multiple institutions within a short period of time – sometimes only minutes apart. This is obviously the work of an organized fraud ring.

Because investigators understand the online channel is vulnerable to fraud, they are giving it more scrutiny. Many are lowering their fraud-score range and/or setting other liberal rules to trigger investigations. Additionally, small institutions may be investigating all online account openings.

While it follows that the more you look, the more you find, the data supports that investigators are indeed finding fraud in the online channel at many times the rate of what they see in the branch channel.

Reducing fraud in the online channel

We’ve seen a major shift over the past few years as we challenge our models to maximize performance; As online account creation grows in popularity, our phone, email, and IP datasets grow increasingly more important in predicting fraud. Right now, the Kevari Fraud Intelligence Platform is the most comprehensive, single source of phone, address, email, and IP data in the industry. We will maintain our position by continuously innovating in this area.

In addition to what we’re doing at Kevari, we believe institutions should consider these steps to reduce fraud in accounts opened online:

- Set specific, more conservative business rules that reflect the vulnerability of the online channel.

- Monitor account openings in real time and investigate risky cases immediately.

- Include robust email/phone/IP data as part of your fraud screening protocol.

- To minimize friction, don’t halt the application process; instead set or limit initial account privileges on risky online accounts until they are fully investigated.

Finally, remember that Kevari is your partner in the battle against new-account fraud. If we can provide of data, insight or solutions to assist you, please don’t hesitate to contact us.