18 percent say they’re on the hunt; this jumps to 38 percent among those primarily using online-only banks, according to a Harris Poll on behalf of Kevari

MINNEAPOLIS (Jun. 30, 2020) — Financial institutions landed right in the middle of the pack in a comparison of how five providers of goods and services responded to changing conditions brought on by the COVID-19 pandemic, according to a new online survey of over 2,000 US adults conducted by The Harris Poll on behalf of Kevari.

Two-thirds (67%) of Americans say they are satisfied with the response of their “primary financial institution” to changing conditions brought on by the COVID-19 pandemic, the survey showed, placing them behind “primary grocery store” (80%) and “primary medical provider” (70%), and ahead of “favorite restaurant” (58%) and “regular place of worship” (46%).

It is possible overall satisfaction with financial institutions could have been higher had it not been for the online-only banking segment. Only 61 percent of customers who primarily use online-only banks are satisfied with their institution’s response to changes due to the COVID-19 pandemic, a significant difference compared to customers who primarily use community banks (74%), credit unions (73%), or mega banks (73%).

“We expected that online-only customers would be the most satisfied because they weren’t being asked to fundamentally change the way they were interacting with their bank,” said Jack Sundstrom, chief product and marketing officer, Kevari. “Something about the experience is falling short of expectations.”

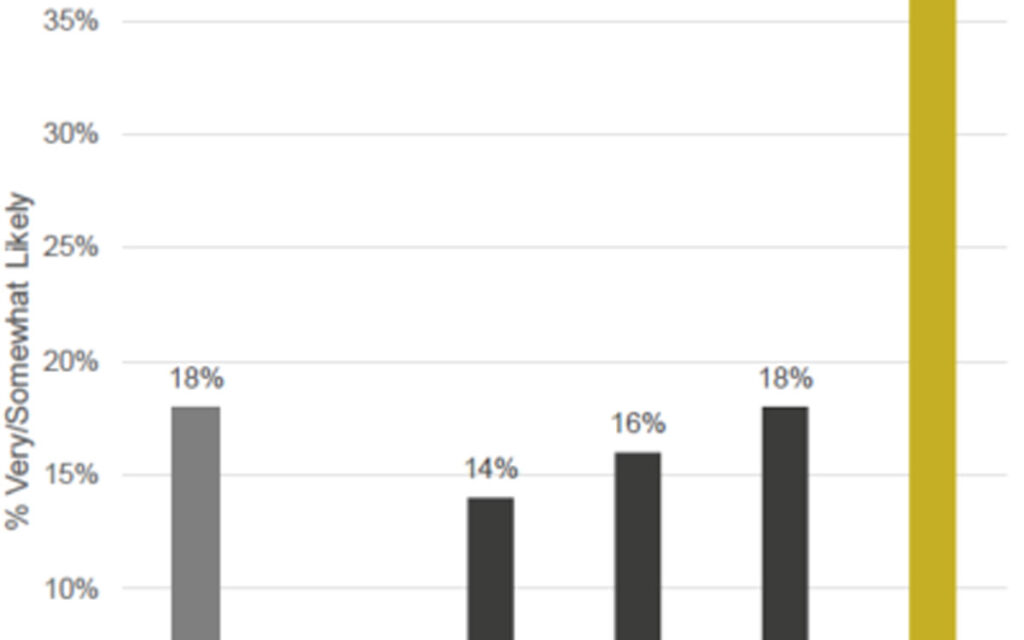

In addition to being the least satisfied, online-only primary banking customers are more likely than those with other types of primary financial institutions to say they would switch to a different primary financial institution as a result of how their current institution responded to changes brought on by the COVID-19 pandemic. While 18 percent of Americans overall say they are likely to switch to a different financial institution from their current primary financial institution, 38 percent of those who primarily use online-only banks say the same. This is more than double the proportion of those who primarily use community banks (18%), credit unions (14%), and mega banks (16%).

“The post-pandemic customer may have an entirely new set of banking expectations,” Sundstrom said. “Until those can be fully understood, the best course of action is to look for opportunities to reduce customer friction – especially in digital processes. For example, people should be able to apply for and make changes to accounts without getting tripped up by clunky identity verification and fraud solutions that can’t reliably tell a criminal from a good customer.”

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of Kevari from June 18-22, 2020 among 2,048 U.S. adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Kevari.

About the Harris Poll

The Harris Poll is one of the longest-running surveys in the U.S., tracking public opinion, motivations and social sentiment since 1963. It is now part of Harris Insights & Analytics, a global consulting and market research firm that strives to reveal the authentic values of modern society to inspire leaders to create a better tomorrow. We work with clients in three primary areas; building twenty-first-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. Kevari is separate from and not affiliated with the Harris Poll, and is not responsible for their services or policies.