News Feed

Background on Identity Fraud Identity fraud poses an ever-present threat to alternative lenders, who often operate in fast-paced digital environments. According

I absolutely LOVE meetings. The more, the better. On Monday and Tuesday of last week alone, I was thrilled to attend

“Success attracts criminal activity.” At least that’s what I heard from many of the alternative lenders at LEND360 in Atlanta. As

At the Datos Insights (formerly Aite Novarica) Financial Crime and Cybersecurity Forum, aside from enjoying a bit of celebrity because Kevari sponsored

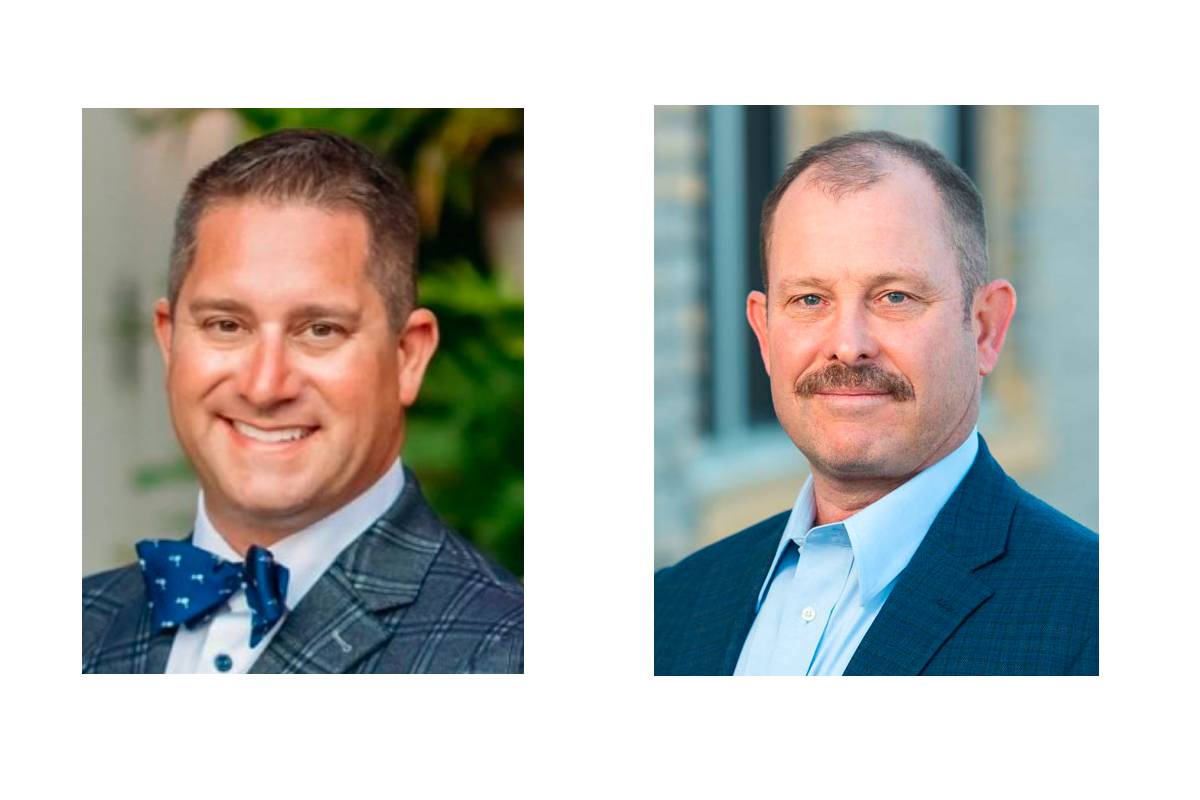

Kevari is pleased to announce the addition of two new board members, Gary Walter and Jack Sundstrom. Walter brings Kevari deep

Truly Unique Data that Supercharges Financial Services Companies’ Existing Fraud Controls and Verification Systems MINNEAPOLIS, Minn. – Today Kevari, a national

Good ideas and insights for fighting fraud deserve to be shared. That’s why it’s my pleasure to share the latest installment

Working in the fraud-fighting industry, I’m a big believer that new insights and ideas need to be shared beyond our own

The increasingly online world means that fraudsters are always attempting new ways to exploit businesses and consumers. In this article published by StrategicCIO360, Kevari

Organized fraud rings are dirty, rotten, and illegal. But aside from that, they have plenty in common with legitimate businesses. Fraud

Fintech Meetup 2023 included 30,000 (you read that right) meetings, all set up and coordinated seamlessly and effortlessly by what the

Victims of identity theft face a number of non-financial ramifications – from sleep problems to severe mental health effects, research shows. Perhaps

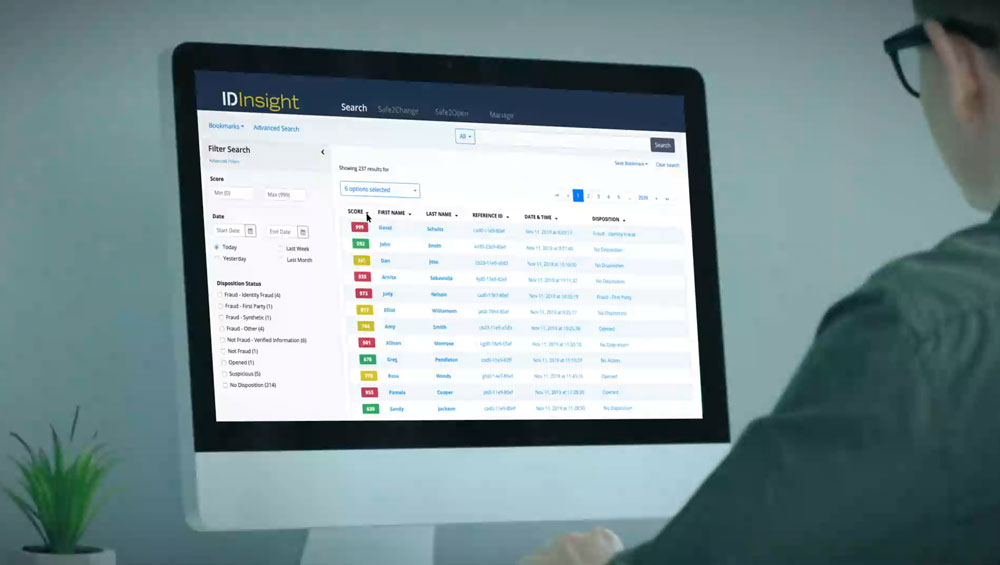

MINNEAPOLIS–(BUSINESS WIRE)–ID Insight, Inc., a national leader in identity fraud prevention based on its Fraud Intelligence Platform, announced today it has

In the July 15 issue of BAI Banking Strategies, Jack Sundstrom, Chief Product and Marketing Officer for Kevari, reported on the

With plenty of stolen data and incredible technology available on the dark web, even the greenest of criminals can fool traditional

Fraudsters are good at adapting. When banks started calling or texting their customers to verify the legitimacy of out-of-pattern account activity,

MINNEAPOLIS, March 11, 2022 /PRNewswire/ — Minneapolis-based Kevari, a national leader in developing platform-based fraud-prevention solutions for business, has been awarded a continuation patent for

While graph theory applications have been in the market for many years, they are gaining popularity because fraud rings are larger,

Survey from Kevari and About-Fraud Uncovers Fraud Fighters’ Opinions About What Financial Services Companies Can Do – and Invest in – to Support Success

When a business is unable to verify the identity of a consumer online, it is often because they can’t match the

Fraudsters can open dozens of fraudulent accounts per day while sitting on a beach in Bermuda.

Investigators draw on experience and expertise to conduct their due diligence, which may include requesting proof documents, conducting interviews, and searching databases.

“I feel the need – the need for speed,” Tom Cruise’s Maverick famously said in “Top Gun.” But while he was

The theme for last week’s MRC | Merchant Risk Council Vegas 2022 was “Back to Business,” and it couldn’t have been more apt.

MINNEAPOLIS, March 11, 2022 /PRNewswire/ — Minneapolis-based Kevari, a national leader in developing platform-based fraud-prevention solutions for business, has been awarded a continuation patent for

Whether driven by compliance policy, fraud policy, or some combination of both – financial institutions that still rely on notification letters

Since Kevari became a part of Minnesota’s tech scene nearly two decades ago, our community has built significant momentum as a

Fraudsters seek out institutions that have weaknesses in their fraud defenses. Once they find these institutions, they capitalize on their opportunities

Last month, an enterprise director of fraud for a large regional bank told me 5% of his new accounts were being

I’ve attended several excellent in-person industry conferences over the past few weeks, but none of them delivered the size and scope

In a recent article for Credit Union Times, Adam Elliott, Founder and President of Kevari writes, “While it is true that

I just returned from LEND360, another in-person conference that was very much worth the trip to Dallas. The event gathered leaders from

Only time will tell how or whether the new USPS standards will impact account takeover rates.

It’s a story that shocked even the most grizzled fraud fighters: The Miami-Dade County Attorney’s Office filed charges against four criminals

It’s an age-old story: If burglars find your front door deadbolted, they’re going to look for an unlocked window. Just like

Jack Sundstrom, chief product and marketing officer for Kevari, wrote an article for Credit Union Times called, “Hanging Up on Phone-Change

In a recent article for Great Lakes Banker, Adam Elliott, Founder and President of Kevari writes, “As you’re assessing opportunities to

Kevari's Fraud Investigation Network allows financial institutions to join forces in the fight against account takeover and new-account fraud. Because organized fraud rings are sharing technology, data and insights designed to defraud financial institutions, it’s critical that banks and credit unions collaborate to defend against this growing threat.

Today, thousands of botnets - connected servers of scripted software robots - can perform what used to require hundreds of hours of manual work in just a few seconds. The results are staggering -- both for banks and their customers.

Authority Magazine recently featured Adam Elliott, Founder and President of Kevari, in its “thought leadership interview series” featuring people who are authorities

Financial services companies need to be prepared for a new tidal wave of stolen PII and credentials. Now more than ever, they must have powerful controls in place to prevent account takeover and new-account fraud. Institutions that aren’t well protected risk losing money, customers, and their reputations.

When the Federal Trade Commission made a public request for comment regarding the 2007 Red Flags Rule, the American Bankers Association

How do you distinguish legitimate address changes from fraudulent ones without causing undue customer friction? What you DON’T do: Rely on change notification letters. The practice of sending change notification letters to comply with Section 114b of the FACT Act Red Flags Rule does almost nothing to proactively prevent fraud. What you SHOULD do: Identify and pursue only the most suspicious address changes. While you’re at it, monitor all email and phone changes, too.

While much of regulatory compliance is now achieved with the help of efficient automated systems, financial institutions still have processes that have not benefited from modern technology. These relics from the past are a drag on the bottom line; they are paper-intensive, inefficient, and expensive. One such relic is the process by which financial institutions are verifying customer/member address changes to comply with The FACT Act Section 114B. Instead of using cost-effective analytics software solutions as the law allows, institutions are printing and mailing letters at a cost of about $1 per address change.

A digital approach to verifying address, phone number, and email changes is more efficient, cost effective, and better at reducing fraud losses in today’s digital banking environment. There’s never been a more perfect time for financial institutions to retire those antiquated address-change letters.

Our bank clients use impressive fintech solutions to identify fraud attempts when money is changing hands. They also understand the importance

Kevari, a Minneapolis-based national leader in developing solutions to prevent account takeover and new-account fraud, announced today that it is applying its award-winning fraud-mitigation technology to launch the Fraud Investigation Network SM, creating the unprecedented level of industry collaboration needed to detect and shut down fraud rings and schemes that target financial institutions.

Machine learning (ML) is one of the fraud-fighting industry’s most powerful weapons in the war against new-account fraud and account takeover.

Accessing data from shared networks is not a new concept for those who investigate fraud. In fact, the ability to view

Javelin’s September 2020 report, “Identity Fraud in the Digital Age,” drove home (again!) the need for financial institutions to work smarter,

For fraud investigators, an effective way to identify organized fraud rings is to look for a lot of activity associated with

As financial institutions strive to deliver consumers a frictionless digital account-opening experience, they should be careful not to skimp on fraud

MINNEAPOLIS August 14, 2020 – With Three-Year Revenue Growth of 90 Percent, Inc. magazine has named Minneapolis-based Kevari, an identity fraud

A decade ago, Kevari scored a big win when Sudheer Prem agreed to leave his R&D position at SAS and become

Fraudsters are using stolen credentials and software bots to hack into your customers’ accounts. Next, they change account addresses, emails, and

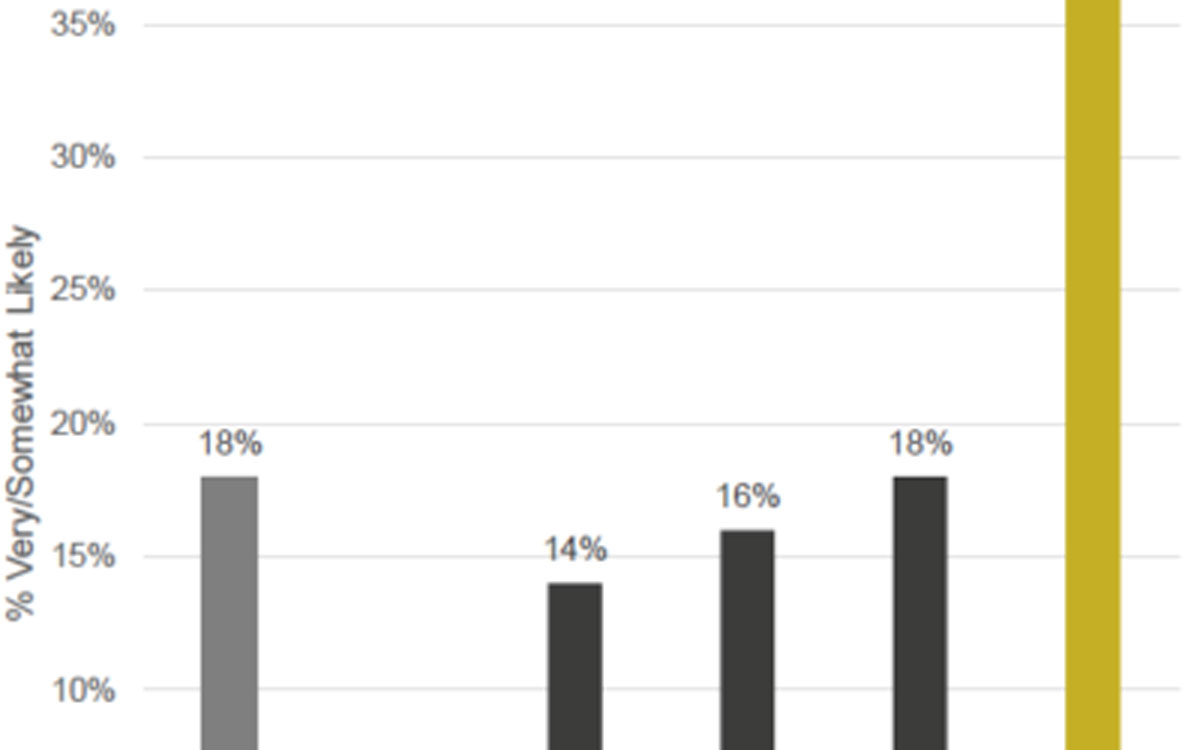

18 percent say they’re on the hunt; this jumps to 38 percent among those primarily using online-only banks, according to a

When COVID-19 forced Americans to stay at home, many banks and credit unions realized their survival now depended on how well

As financial institutions face new and more complex fraud schemes in both account takeover and new-account fraud, there is an acute

Fraudsters often have better technology for committing fraud than banks have for stopping it. This is particularly true when it comes

Like you, we’ve heard a wide range of estimates – from industry analysts, research firms, and financial institutions – regarding the