News Feed

Navigating Fraud Challenges for Alternative Lenders

Background on Identity Fraud Identity fraud poses an ever-present threat to alternative lenders, who often operate in fast-paced digital environments. According to the 2023 Identity

Nothing But Love For Money 20/20

I absolutely LOVE meetings. The more, the better. On Monday and Tuesday of last week alone, I was thrilled to attend 23 meetings – a

Alternative Lenders Seek New Partnerships to Fight Fraud

“Success attracts criminal activity.” At least that’s what I heard from many of the alternative lenders at LEND360 in Atlanta. As traditional lenders have adjusted

Top Three Takeaways From the Financial Crime Forum

At the Datos Insights (formerly Aite Novarica) Financial Crime and Cybersecurity Forum, aside from enjoying a bit of celebrity because Kevari sponsored the gourmet coffee carts,

Kevari Announces New Board Members

Kevari is pleased to announce the addition of two new board members, Gary Walter and Jack Sundstrom. Walter brings Kevari deep experience in the areas

Kevari Introduces the Kevari Data Network

Truly Unique Data that Supercharges Financial Services Companies’ Existing Fraud Controls and Verification Systems MINNEAPOLIS, Minn. – Today Kevari, a national leader in helping financial

Innovations in Fraud Fighting: Interview with FIS Global’s Head of Fraud, Risk and Compliance

Good ideas and insights for fighting fraud deserve to be shared. That’s why it’s my pleasure to share the latest installment of my Industry Leader

Fraud-Fighting Challenges: Interview with the Kevari CEO

Working in the fraud-fighting industry, I’m a big believer that new insights and ideas need to be shared beyond our own companies if we are

Kevari CTO, Sudheer Prem, Tells StrategicCIO360 That Fraud Challenges Can Lead To Opportunities

The increasingly online world means that fraudsters are always attempting new ways to exploit businesses and consumers. In this article published by StrategicCIO360, Kevari CTO, Sudheer Prem, discusses how

Time to Join Forces to Defend Against Fraud Rings

Organized fraud rings are dirty, rotten, and illegal. But aside from that, they have plenty in common with legitimate businesses. Fraud rings invest in talent,

Test Post 051023

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi

Identity Fraud Insights Plentiful at Fintech Meetup

Fintech Meetup 2023 included 30,000 (you read that right) meetings, all set up and coordinated seamlessly and effortlessly by what the organizers call their “magical”

Identity Theft Takes an Emotional Toll on Consumers

Victims of identity theft face a number of non-financial ramifications – from sleep problems to severe mental health effects, research shows. Perhaps it’s no wonder victims

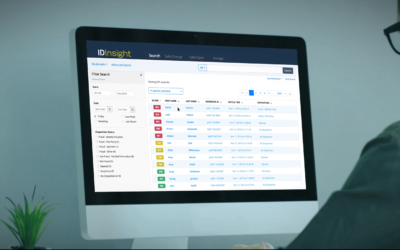

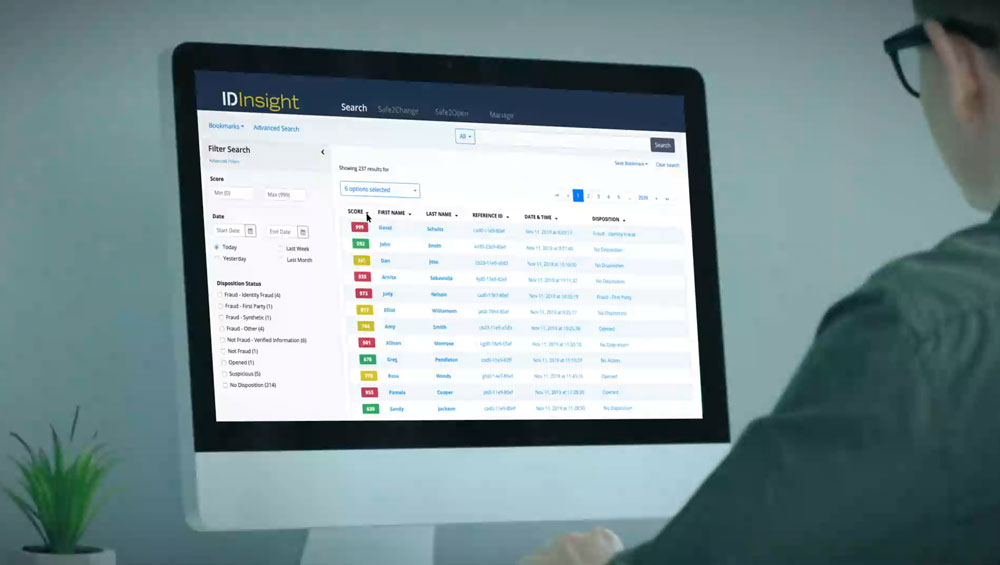

ID Insight is now Kevari

MINNEAPOLIS–(BUSINESS WIRE)–ID Insight, Inc., a national leader in identity fraud prevention based on its Fraud Intelligence Platform, announced today it has changed its name to

Kevari in BAI: What Frontline Fraud Fighters are Seeing in Financial Services Companies

In the July 15 issue of BAI Banking Strategies, Jack Sundstrom, Chief Product and Marketing Officer for Kevari, reported on the company’s recent survey of

Fraudsters are on a Feeding Frenzy

With plenty of stolen data and incredible technology available on the dark web, even the greenest of criminals can fool traditional identity verification and risk-screening

Fraudulent Phone Number Changes: A Growing Problem

Fraudsters are good at adapting. When banks started calling or texting their customers to verify the legitimacy of out-of-pattern account activity, like big money transfers,

Kevari Awarded Continuation Patent for SEEKSM Technology

MINNEAPOLIS, March 11, 2022 /PRNewswire/ — Minneapolis-based Kevari, a national leader in developing platform-based fraud-prevention solutions for business, has been awarded a continuation patent for its technology designed to

Visualization Becoming More Important in Understanding Organized Fraud

While graph theory applications have been in the market for many years, they are gaining popularity because fraud rings are larger, more complex, and more

New Research: 81% of Frontline Fraud Fighters Say Financial Services Organizations Could be Doing More to Fight Fraud

Survey from Kevari and About-Fraud Uncovers Fraud Fighters’ Opinions About What Financial Services Companies Can Do – and Invest in – to Support Success

Podcast: New Addresses Can Make It Harder for Consumers to Open Accounts

When a business is unable to verify the identity of a consumer online, it is often because they can’t match the consumer’s static identity information,

Could Email Be the Fraudster’s Achilles Heel?

Fraudsters can open dozens of fraudulent accounts per day while sitting on a beach in Bermuda.

Fraud Investigators’ Due Diligence Becomes a Simple, Powerful Data Attribute

Investigators draw on experience and expertise to conduct their due diligence, which may include requesting proof documents, conducting interviews, and searching databases.

SEEK Technology: When You Have the Need for Speed

“I feel the need – the need for speed,” Tom Cruise’s Maverick famously said in “Top Gun.” But while he was referring to piloting a

Getting “Back to Business” with the Merchant Risk Council

The theme for last week’s MRC | Merchant Risk Council Vegas 2022 was “Back to Business,” and it couldn’t have been more apt. I don’t know if

Kevari Awarded Continuation Patent for SEEK(SM) Technology

MINNEAPOLIS, March 11, 2022 /PRNewswire/ — Minneapolis-based Kevari, a national leader in developing platform-based fraud-prevention solutions for business, has been awarded a continuation patent for its technology designed to

Address Changes: The Pitfalls of Paper Processes

Whether driven by compliance policy, fraud policy, or some combination of both – financial institutions that still rely on notification letters and signature forms to

Minneapolis-St. Paul Event Features Adam Elliott Discussing Minnesota as Rising Tech and Innovation Hub

Since Kevari became a part of Minnesota’s tech scene nearly two decades ago, our community has built significant momentum as a player on the national

Why a Multi-layered, Enterprise-wide Approach is Needed to Mitigate Account Takeover and New-Account Fraud

Fraudsters seek out institutions that have weaknesses in their fraud defenses. Once they find these institutions, they capitalize on their opportunities to launder and steal

Digital Account Opening Requires a Leading-Edge Fraud Defense

Last month, an enterprise director of fraud for a large regional bank told me 5% of his new accounts were being opened online. He asked

Insights and Takeaways from Money2020

I’ve attended several excellent in-person industry conferences over the past few weeks, but none of them delivered the size and scope of Money20/20, fintech’s largest

How Credit Unions Can Keep a Step Ahead of Fraudsters

In a recent article for Credit Union Times, Adam Elliott, Founder and President of Kevari writes, “While it is true that fraudsters have upped their

Insights and Takeaways from LEND360

I just returned from LEND360, another in-person conference that was very much worth the trip to Dallas. The event gathered leaders from across the country to

Could New USPS Service Standards Affect Account Takeover Rates?

Only time will tell how or whether the new USPS standards will impact account takeover rates.

Opportunistic Identity Thieves Preyed on the Dead. Here’s What Needs to Change.

It’s a story that shocked even the most grizzled fraud fighters: The Miami-Dade County Attorney’s Office filed charges against four criminals who stole the identities

Stopping Digital Identity Fraud Requires a Multi-layered Detection Approach

It’s an age-old story: If burglars find your front door deadbolted, they’re going to look for an unlocked window. Just like brick-and-mortar criminals, identity thieves

Insight on the Role of Phones in Account Takeover

Jack Sundstrom, chief product and marketing officer for Kevari, wrote an article for Credit Union Times called, “Hanging Up on Phone-Change Fraud,” stressing the need

Founder Elliott Asks: Is it Time to Relegate Address Verification Letters to the Trash Heaps of History?

In a recent article for Great Lakes Banker, Adam Elliott, Founder and President of Kevari writes, “As you’re assessing opportunities to embrace modern technology and

Kevari in BAI: Financial Institutions Must Join Forces Against Organized Fraud

Kevari’s Fraud Investigation Network allows financial institutions to join forces in the fight against account takeover and new-account fraud. Because organized fraud rings are sharing technology, data and insights designed to defraud financial institutions, it’s critical that banks and credit unions collaborate to defend against this growing threat.

Robot Fraud: How Botnets are Powering ATO

Today, thousands of botnets – connected servers of scripted software robots – can perform what used to require hundreds of hours of manual work in just a few seconds. The results are staggering — both for banks and their customers.

Founder Adam Elliott Featured in Authority Magazine’s Leadership Series

Authority Magazine recently featured Adam Elliott, Founder and President of Kevari, in its “thought leadership interview series” featuring people who are authorities in Business, Pop Culture,

Javelin’s Identity Fraud Study Highlights Scams That Let Criminals Capitalize on Stolen Information

Financial services companies need to be prepared for a new tidal wave of stolen PII and credentials. Now more than ever, they must have powerful controls in place to prevent account takeover and new-account fraud. Institutions that aren’t well protected risk losing money, customers, and their reputations.

Account takeover schemes are rarely limited to physical address alone

When the Federal Trade Commission made a public request for comment regarding the 2007 Red Flags Rule, the American Bankers Association and Attorneys General from

Why You Can’t Afford an Old-Fashioned Approach to Address Changes

How do you distinguish legitimate address changes from fraudulent ones without causing undue customer friction? What you DON’T do: Rely on change notification letters. The practice of sending change notification letters to comply with Section 114b of the FACT Act Red Flags Rule does almost nothing to proactively prevent fraud. What you SHOULD do: Identify and pursue only the most suspicious address changes. While you’re at it, monitor all email and phone changes, too.

Still Mailing Address-Change Letters? You Can’t Be Serious!

While much of regulatory compliance is now achieved with the help of efficient automated systems, financial institutions still have processes that have not benefited from modern technology. These relics from the past are a drag on the bottom line; they are paper-intensive, inefficient, and expensive.

One such relic is the process by which financial institutions are verifying customer/member address changes to comply with The FACT Act Section 114B. Instead of using cost-effective analytics software solutions as the law allows, institutions are printing and mailing letters at a cost of about $1 per address change.

Podcast: Address-Change Verification Does Not Have to Grow on Trees or Cost So Much

A digital approach to verifying address, phone number, and email changes is more efficient, cost effective, and better at reducing fraud losses in today’s digital banking environment. There’s never been a more perfect time for financial institutions to retire those antiquated address-change letters.

Detect ATO by Scrutinizing Non-Monetary Transactions in Real Time

Our bank clients use impressive fintech solutions to identify fraud attempts when money is changing hands. They also understand the importance of scrutinizing non-monetary transactions,

Kevari Launches Financial Institution Fraud Investigation Network(SM)

Kevari, a Minneapolis-based national leader in developing solutions to prevent account takeover and new-account fraud, announced today that it is applying its award-winning fraud-mitigation technology to launch the Fraud Investigation Network SM, creating the unprecedented level of industry collaboration needed to detect and shut down fraud rings and schemes that target financial institutions.

Podcast: Machine Learning is Fortification in the Battle Against Identity Fraud

Machine learning (ML) is one of the fraud-fighting industry’s most powerful weapons in the war against new-account fraud and account takeover. It can expose new

New National Network Makes it Easy for Banks, Credit Unions to Fight Fraud Together

Accessing data from shared networks is not a new concept for those who investigate fraud. In fact, the ability to view the velocity of consumer

Podcast: A New Collaborative Way to Stop Account Takeover and New-Account Fraud

Javelin’s September 2020 report, “Identity Fraud in the Digital Age,” drove home (again!) the need for financial institutions to work smarter, faster, and more collaboratively

The Case for a Fraud Investigation Network

For fraud investigators, an effective way to identify organized fraud rings is to look for a lot of activity associated with a particular communication endpoint,

Podcast: The Dash to Digital Account Opening

As financial institutions strive to deliver consumers a frictionless digital account-opening experience, they should be careful not to skimp on fraud detection. In a recent

Kevari Makes the 2020 Inc. 5000

MINNEAPOLIS August 14, 2020 – With Three-Year Revenue Growth of 90 Percent, Inc. magazine has named Minneapolis-based Kevari, an identity fraud prevention and detection software

CTO Sudheer Prem Marks 10 Years with Kevari

A decade ago, Kevari scored a big win when Sudheer Prem agreed to leave his R&D position at SAS and become our Chief Technology Officer.

Podcast: When Hackers Access an Account, Here’s How to Stop Them

Fraudsters are using stolen credentials and software bots to hack into your customers’ accounts. Next, they change account addresses, emails, and phone numbers to cut

Response to COVID-19 Compels Some Consumers to Seek New Banking Relationships

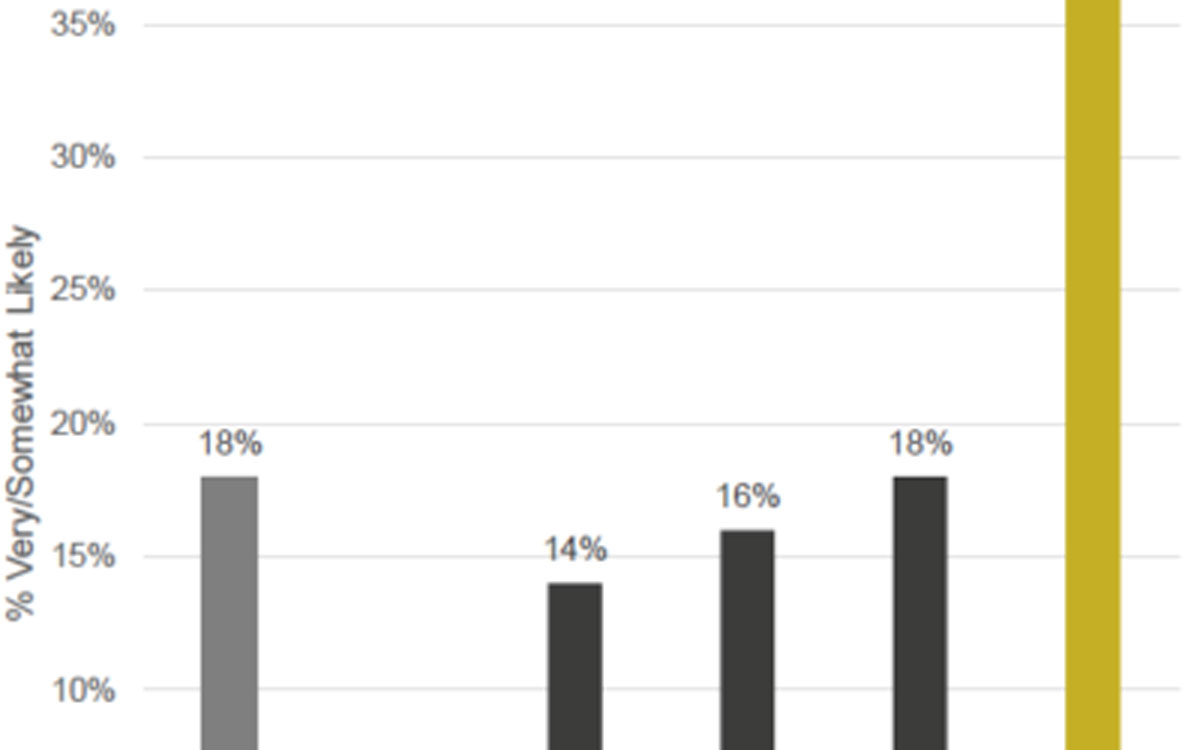

18 percent say they’re on the hunt; this jumps to 38 percent among those primarily using online-only banks, according to a Harris Poll on behalf

Acceleration in Digital Banking Adoption Means More Fraud

When COVID-19 forced Americans to stay at home, many banks and credit unions realized their survival now depended on how well they could serve customers

Podcast: Examining Non-Monetary Data Key to Catching Identity Fraud

As financial institutions face new and more complex fraud schemes in both account takeover and new-account fraud, there is an acute need for fraud prevention

Manual Reports: No Match for Today’s Account Takeover Schemes

Fraudsters often have better technology for committing fraud than banks have for stopping it. This is particularly true when it comes to account takeover (ATO).

Fraud Rate is Higher in the Online Channel. But How Much Higher?

Like you, we’ve heard a wide range of estimates – from industry analysts, research firms, and financial institutions – regarding the fraud rate in DDAs

Insight on New Account Fraud Creating Friction for Banks

Adam Elliott, Kevari founder, wrote an article for ABA Risk and Compliance called, “New Account Fraud Creates Friction for Banks.” Losses from fraudulent new accounts